Quick Start

The following is a stereotypical example of how StockWave™ would typically be used.

Start the Application

Decide what you want to do — look at

tutorials, browse the share price and company

information, or go straight to your portfolio and

start trading.

Start Tutorial — links you to a set of Webpages which explain the history and mechanics of the stock market; what you need to know to get you started. Background material.

Market News — shows where todays market action is and recent news stories from the mainstream financial media; this is a useful starting point for further enquiry.

Create a Portfolio — a portfolio holds together your individual trading interests; trades you've made, analysis you've done, your broker accounts.

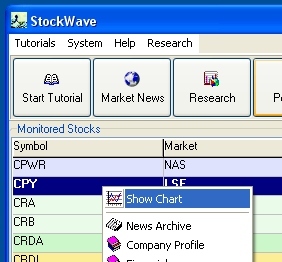

Choose a stock by clicking on its entry on the

main grid; if you then right-click you will get

further choices.

Research — use this to search the internet for useful chunks of information.

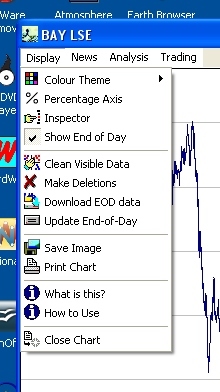

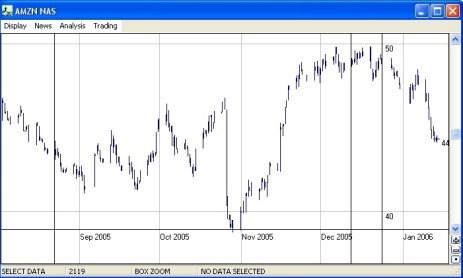

Open a Stock Chart

Customise the look and feel; check the news; do some analysis, get a prediction about the market.

Select a region of interest — zoom in to

where the action is

Change the look — choose a different colour

scheme

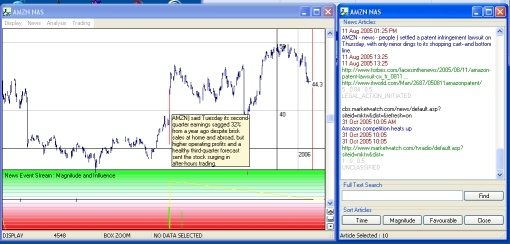

See the news events in relation to the market

moves

Select Data — drag from the left edge of

the desired range to the right extremity.

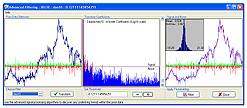

Use the data selection to so some analysis

— check the price move histogram, open the

advanced filtering tool or run a Monte Carlo

simulation to create a probabilistic

prediction.

Check other Information

Automatic queries can be created from the context

menu.

Open your Portfolio

Create a new portfolio if you do not have one

already — you need to enter your name,

email address and phone number.

Once your portfolio is open, you can proceed to

analysis and trading, in particular you can

create probabilistic predictors from the Monte

Carlo tools on the StockChart menu.

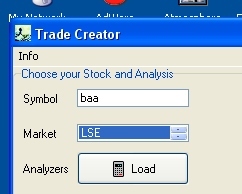

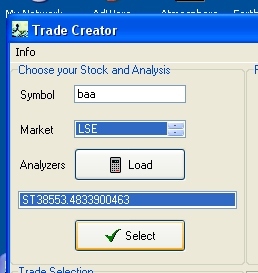

Go to the Trade Creator

This can be used to craft complex trades; work left to right, and top to bottom.

First of all select a stock of interest

— you need to enter its symbol and market

designation. Trade Creator will then check your

portfolio for any available analysis for this

stock; if it finds any it will load it to the

analysis list.

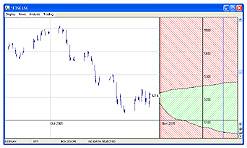

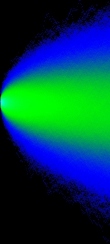

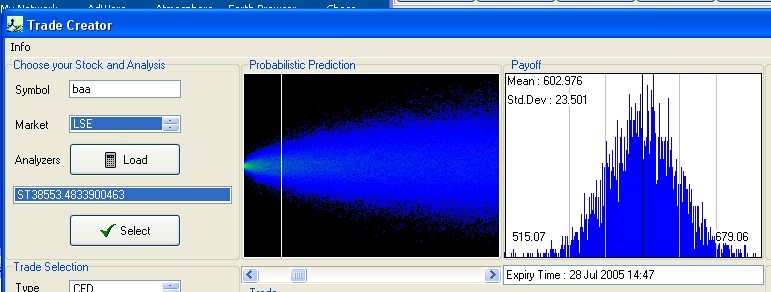

If the analysis list is non-empty you can load

one of the probabilistic predictors onto the

form; a two dimensional image will be loaded onto

the middle left hand panel — the colours on

this image represent probability; the brighter

the spot, the more chance of the price achieving

that given value. The contour lines represent the

concentration of probability, e.g. between the

two 50 lines, there is a 50% chance that the

share price will be bounded by these lines. The

analysis we have chosen should represent our best

prediction for the future share price — we

are going to use this to evaluate the performance

of the trades we create (NB the analysis can be

changed if we want to see a 'different

opinion').

When trading we assume that it will be for a

finite time only (no 'buy-and-hold' here!)

— we wish to open a trade, let it run for a

while, then close it to realize a profit;

select the implied closing time for the

trade we are about to construct by sliding the

scrollbar underneath the middle left panel; on

the middle right hand panel you should see a

histogram — this is a one dimensional slice

of our two dimensional image and shows the price

probabilities for the current stock at the

selected closing time.

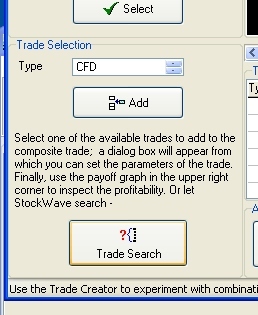

Next, select a trade. On the bottom

extreme left panel you will see a drop down list

which contains a number of trade types —

these are ordinary stock trades, CFDs

(contracts-for-difference, this is a derivative

which simulates a stock trade, but without the

stamp duty), spread bets and options. Choose one

of these types; a form will appear containing the

trade parameters. Currently you have to set these

by hand, but its not too hard — the main

thing is to get accurate current bid and offer

prices for the trade, possibly from an online

brokerage, and set reasonable estimates for the

transaction charges you will incur. One the

parameters are entered, we can get our payoff

graphs.

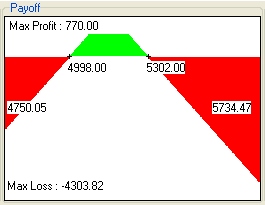

Once the trade parameters are entered the program

can calculate the profit and loss figures for any

closing price; you can see this by looking at the

profit-price graph on the middle right

panel — red represents a loss and green

represents a profit; from this we can read off

our profit and loss regions, and also find where

the breakeven points are. But we can go even

further than this.

Remember from our analysis we have the price probability at the closing time; and from our trade selection we have our price profit graph — by putting the two of these together we can produce a profit probability graph. This is the crucial point in our analysis for it tells us very concisely all we need to know, and from it we can produce summary measures that tell us what we really want to know, i.e. how much do I expect to make, what are my chances of making money, and how much could I lose?

There is more to the Trade Creator than even this; we can use different analyses if we want to, and we can build composite trades. Composite trades are combination trades crafted specifically to take advantage of current market conditions. Combination trades can be made with Trade Creator — all the payoff calculations are done automatically.

And yet there's more... rather than spending a

lot of time hand-crafting a trade, why not use

the AutoSearch facility. You start by

entering a number of basic trades to seed the

algorithm, then it exhaustively calculates the

payoff measures for all possible trade

combinations, producing a summary list of the

best trades found as its output.

Make a Trade

Check the Payoff Graph — if you like the chances of the return, then make the trade.

Set your Alarms

Once a trade has been made a trade alarm is set

which warns you if the price is moving badly

against you.