|

|

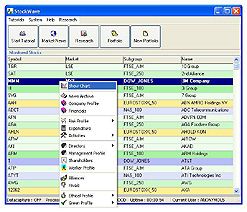

Main Window

From here, you can access everything that you

need. You can see a list of stocks and select

one. Various options are shown on the

right-click menu. For example, you can choose

to show the chart.

The pastel colours serve a purpose; the three

geographical areas are identified by a

colour, for example, green for UK stocks,

blue for US stocks, and orange for European

stocks. The darker the shade, the larger the

company.

|

|

|

|

Data-Capture

Data sources are held here and updated from

time-to-time in priority (oldest first). You

can decide how often to capture data. For

example, you might decide to visit one data

source every 5 minutes — and another

every 25 minutes.

You can get data from Teletext and the

Internet, and everything can be configured to

your taste and your PC's settings. This means

StockWave™ can accommodate both the

power user and the not-very-powerful-at-all

user. The point of this is to shorten the gap

between the serious almost-professional

investor or trader — and the

ordinary-ish Joe.

It's worth pointing out that you can get data

from different types of sources, for

different stocks, which can be easily

tailored to your needs, simply by casting a

wide net. It's also possible use an existing

subscription.

|

|

|

|

Teletext

StockWave™ can use the Teletext

application that comes with Hauppauge WinTV

cards.

Teletext is a great way to get data —

and is often overlooked. If you've got a

low-specification PC, or would be a casual

user, this feature is ideal for you. It's

free!

|

|

|

|

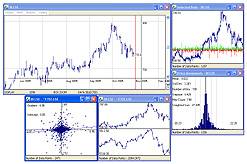

Charting

The chart is at the centre of

StockWave™ — looking at the share

price is your main activity. You may zoom in

and out, select data for analysis, and view

the analysis that you've done.

|

|

|

|

Chart with integrated News

Viewing

You can also see news events as they relate

to share prices, and by moving the cursor

over the chart, see when a news event

happened.

You can get a feel for what affects prices

— some things do, some don't.

|

|

|

|

Basic Analysis Tools

From the chart, you can access various

analytical tools. The screenshot shows the

data that has been selected for analysis; a

histogram showing the distribution of price

movements; a multi chart showing the stock

plotted against another; and a scatter chart

showing how movements are related to

movements in another stock.

|

|

|

|

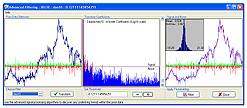

Advanced Filtering

Using advanced filtering, you can apply

signal processing techniques to your

data.

The aim is to separate the underlying trend

from the noise.

|

|

|

|

|

Probabilistic Prediction

Ideally, you want to know where a share price

will go in the future. Unfortunately,

predictions of this kind are pretty much

impossible, given the nature of share

prices.

What is possible, however, is calculating

probabilities (or 'true odds') of where the

price is likely to go. The technique used is

called 'Monte Carlo simulation,' and its

output is shown on the chart.

The hotter regions show where the share price

is more likely to go. And, once you know the

true odds, you can create a profitable

trading strategy.

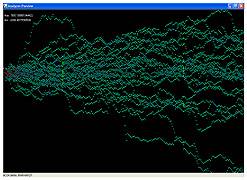

The second screenshot shows a Monte Carlo

simulation that has just started. You can see

the paths of the individual random walks. The

probabilistic prediction overlay has contours

showing the probability (in percent) that the

price will be, within the boundaries on a

given day.

|

|

|

|

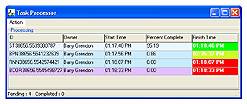

Task Processor

Several types of Monte Carlo simulation are

available — some of which are very

processor-hungry. To make the application

usable during the number crunching, all heavy

work is carried out in background threads and

held in the task processor.

The progress of each job is shown, as well as

the likely finish time. If a job is taking

too long, you can pause or delete it.

|

|

|

|

Portfolio Window

Each user's trading interests are held in

their portfolio. You can select a portfolio

using the menu and look at the trades they've

made, analyse what they've done, and see the

status of any trade alarms. Open positions

are updated in real-time if data-capture is

running.

|

|

|

|

|

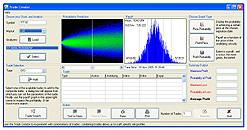

Trade Creator

The trade creator is probably the most

important tool — certainly it is the

most complex, and the crux of the whole idea

of StockWave™. It lets you select any

piece of analysis, plus any possible trades

that you could make, and have the payoff

calculated and displayed.

On the payoff graph, red is a loss and green

is a profit. Breakeven points are shown by a

cross. Trading costs, if known, can be

incorporated into the calculation.

The point of this is to help you make profits

with high-probability trades.

The trade creator handles different types of

trade — CFDs, spread bets and

options.

In the second screenshot, there's a 'short

strangle' combination trade. This is an

options trade which involves selling a Call

option and a Put option. Making this trade

means that you'll profit if the share price

stays between two prices, but make a loss if

it finishes outside either edge.

Note that the profit level is capped, while

potential losses grow with the distance

outside the green region. Red triangles on

the payoff graph show danger — and a

short strangle has two of these.

When you're ready, you go onto make a trade.

It's entered into your portfolio, where you

may inspect it. Open trades are shown in red

and closed trades in green. Current profit or

loss is shown and indicated similarly.

(You aren't actually making a trade here

— you need to go to your online broker

and make the trade there; StockWave is not

yet a trading platform.)

The complex possibilities of the various

combinations are overwhelming. To solve this

problem, there's the trade searcher.

|

|

|

|

Automated Trade Searcher

This takes a number of seed trades (for

example, from an options table), then

exhaustively calculates the payoffs for all

combinations, to a given depth (up to a

maximum of six).

The best trades are on the left hand side.

You can select one of these and view it in

the trade creator.

|

|

|

|

Trade Alarm

When a trade is created, a trade alarm, which

knows the 'safe' and 'dangerous' regions for

that share price to go to, is set up.

Generally speaking, the deeper into a region

a price goes, the better / worse you'll

fare.

If the price stays in the green, you'll be in

profit at closing time. If your trade starts

to wander off track, an alarm will be sent to

your mobile phone.

It's simple; do some analysis, find the

trades with the best chance of payoff, set

the alarm, then make sure the price stays in

the green.

|

|

|

|

|

News Event Analysis

Most of what makes share prices move as they

do is probably already in the share price

itself — but not always.

News events are shown alongside the chart to

let you see if there's anything that may be

having a special effect. This is a useful

visual check. However, StockWave™ goes

further by offering definite quantitative

assessment of the effects of news events on

the price.

The scatter chart lets you take a sample of

news events and see what the actual price

response was; the right hand side shows the

price response and the left hand side shows a

graph of the expectation.

Again, red and green are used to show 'good'

and 'bad.' News events are shown as crosses.

When you move the cursor over them, you get a

text display of what it actually was.

|

|

|

|

Market Summary

The market summary shows the biggest share

price movements — up or down —

plus the day's headlines.

Clicking on a headline lets you browse the

original data source.

|

|

|

|

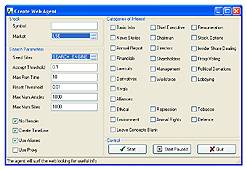

Web Agent

Create your own program to dig deep for

information about a company's prospects and

operations.

Most publicly-traded companies are large,

complex beasts with a very great deal going

on inside them.

If you want to think about fundamentals, then

simply looking at the company report is not

enough — you've got to look deeper to

gather and evaluate information from a

variety of sources. This is called the

'scuttlebutt approach to investing.'

|

|

|

|

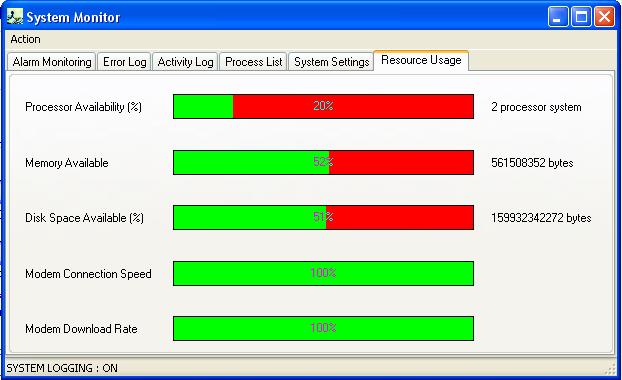

System Sentinel

StockWave™ can easily use-up whatever

resources your PC has �

and can do a lot of thing simultaneously; the

sentinel is a centralised monitoring facility

that will help you get the best out of the

machine you've got.

The system sentinel lets you check system

loading, recent activities, and also any

error messages, for example, with a data

source that's not responding.

|

|

|

|

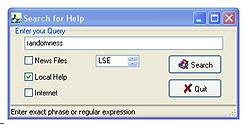

Local Help

There are full text search facilities for the

StockWave™ help files and its news

archives.

|

|

|

|

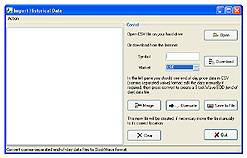

Import Historical Price Data

Get end-of-day price data from any free

Internet data sources.

|

|

|

|

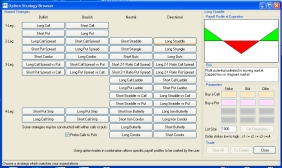

Options Strategy Browser

See payoff profiles for 40 options

strategies.

|